What happened last week?

After four days of small losses equity indexes rallied on Friday, gaining three-quarters of a percent for the Dow and the TSX, one and one-quarter for the S&P 500 and one and three-quarters for the NASDAQ. After a disappointing December for equity returns an upturn at the end of the first week of 2025 was welcome news.

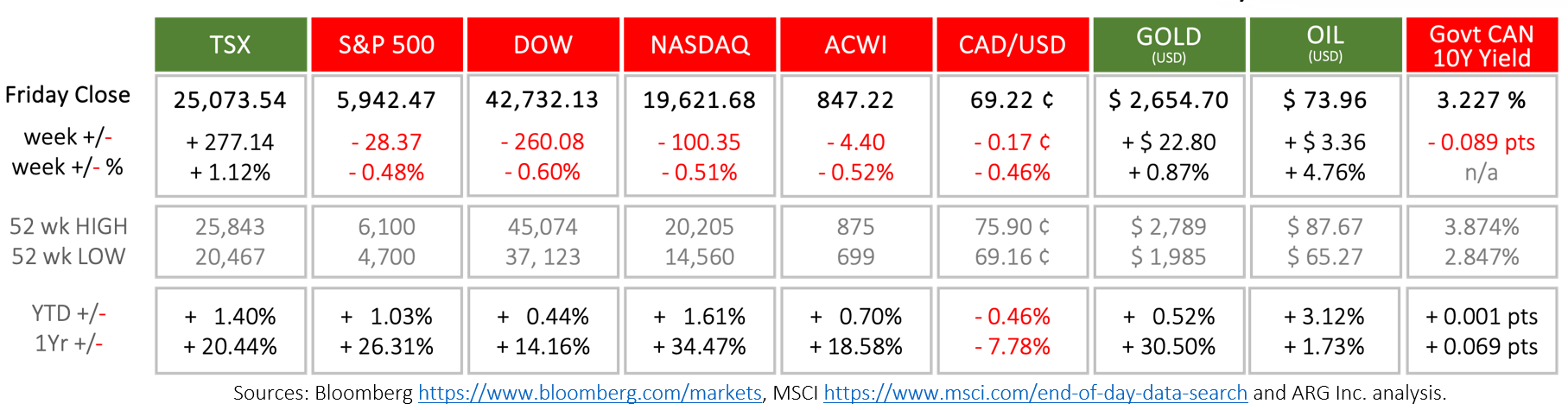

Nonetheless the TSX was the sole index to produce a gain last week, while the U.S. major indexes delivered about one-half percent each.

The Canadian dollar continued its slide against its American counterpart. Gold and oil rose, while bond yields fell again.

Trading volumes have traditionally been below typical levels between Christmas and New Year’s Eve, and this year was not an exception. A return to normal levels will occur next week.

What’s ahead for this week and beyond?

In Canada, imports, exports and trade balance, several Purchasing Managers Indexes ((PMI) and an employment report, on Friday, will be released.

In the U.S, durable goods and factory orders, vehicle sales, November’s trade balance and ADP’s employment change will be reported. The Bureau of Labor Statistics will release its nonfarm payroll report. The meeting minutes from the Federal Reserve’s most recent Federal Open Market Committee (FOMC) interest rate decision will also be released.

Globally, China’s Consumer Price Index (CPI) and Producer Price Index (PPI), Eurozone’s CPI, PPI, and Harmonized Index of Consumer Prices (HICP), Japan’s household spending, consumer confidence and wages will be announced.